sick pay calculator

Payroll runs the employees last paycheck using the old pay rate to calculate earnings. You can use the Leave Calculator to calculate personal leave.

Therefore the sum to calculate Janes SSP entitlement looks like this.

. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise. Enter your annual salary in the field above and select how frequently you get paid and how many days per week you work. This is a period of sickness lasting four days in a row. 50 for half pay.

Calculate your employees statutory sick pay. Either double-click an existing rule or click New OSP to create a new rule. You must have worked with your employer for at least 90 days to be eligible for. PIW Period of Incapacity for Work.

9425 7 qualifying days 1346 of SSP per day. This is normally an amount based on their normal pay. Hi I would welcome any guidance you could give me about calculating the number of days in a rolling year. If you have some leave paid at a fraction of your normal pay you can enter the number of days and the rate at which you get paid eg.

Now her retirement will. Sick leave calculation guide. Fixed employees get 3 days of paid sick days at the beginning of each year. How sick pay is calculated If an individual is off for a long period and their length of service entitles them to a different level of entitlement this is not activated until their return to work.

Employees get to rollover any unused sick time to the next year up to a cap of 48 hours. LEAVE ACCRUAL CALCULATOR. Under IRS guidance eligible employers who pay qualifying sick or childcare leave under the Families First Coronavirus Response Act FFCRA will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and childcare leave that they paid rather than deposit them with the IRS. Go to PayrollCalculate Payrollchoose your pay date and employee Calculate Payroll 3 Record the hours of Sick Time taken Calculate Payroll 4 Choose the reports you wish to view.

Are an employee and have already carried out work for your employer. Under the NES full time employees are entitled to 10 days paid personal leave for sick and paid carers leave per year. How to use the Maternity and Sick Pay Calculator. Entitlement is calculated on a rolling 12 month basis so all sickness absence in a 12 month period is included for the purposes of the calculation.

Total Hours on Pay Status includes vacation sick leave paid holidays and other hours in lieu of REG hours. Sick and carers leave comes under the same leave entitlement. This information is provided by the Department of Commerce as a general guide. Its also known as personal carers leave.

You can work out the daily rate for your employee by dividing the weekly rate by the number of QDs in that week. There are 2 Methods You Can Use to Calculate Sick Pay Hours. The Leave Calculator calculates. For SSP purposes the week always begins on a Sunday.

1346 x 4 days 5384 in Statutory Sick Pay. As an employer you can choose to offer more than SSP to your employees as part of their benefits package. A fortnightly-paid employee working three days a week will accrue sick leave at a rate of 023 days per fortnight which is. 43333 is the average number of weeks in a month calculated as 52 12.

Earn a minimum of 120 a week before tax have been ill or self-isolating for at least 4 days in a row. When sick pay is used - the hours are deducted when you Calculate Payroll. The items below are my column headings First Day of AbsenceLast Day of Absencenumber of days offnumber of sick days within a 12 month periodnumber of sick periods in 12 month period Example data Column A First day 13082013 Column B Last Day. This is planned to increase to 5 days in 2023 7 days in 2024 and 10 days in 2025.

You are entitled to receive Statutory Sick Pay if you. Sick Leave Accrual policy indicates that an employee must be on pay status for at. Effective January 1 2022 you can take up to 5 days of paid leave per year for any personal illness or injuryYour employer may request reasonably sufficient proof of illness. A rate of payment for statutory sick leave of 70 of normal wages to be paid by employers up to a maximum 110 per day.

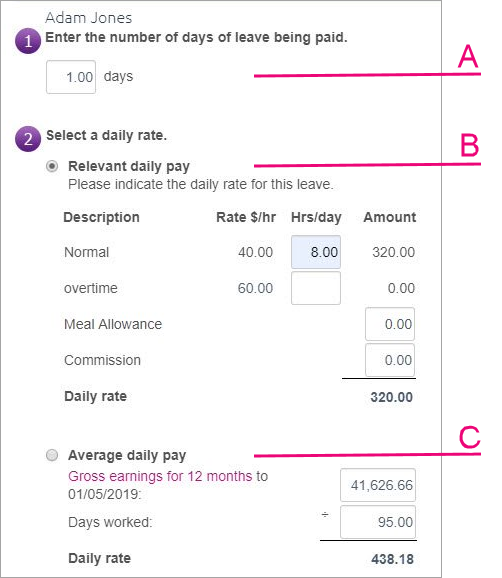

Paid personal leave accumulates from year to year. The calculation for the OSP Pay Element is the Daily Rate multiplied by the amount of working days that the employee was sick for. An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department. If your registered agreement has more generous leave entitlements than the NES you shouldnt use this calculator.

Dont forget clever payroll software will take into account legislative changes to SSP and auto-apply new rates to your payroll. You can also calculate an employees statutory sick pay using the following SSP Calculator. Using the 2087 hours sick leave chart that will add an additional 4 months and 28 days to her creditable service. The example shows 8 hours of Sick Time was used.

If youre lucky your software will take care of other sick calculations such as Occupational Sick Pay OSP. You can use the Leave Calculator to find out how much annual leave has accumulated under your award or under the National Employment Standards NES. Part-time employees receive a pro-rata entitlement to sick leave based on the number of hours they work. A monthly-paid employee working five days a week will accrue sick leave at a rate of 083 days per month which is calculated as 5 x 43333 26.

The days which qualify as working days in this instance is determined by the SSP Entitlement tab located in the Employee. Accrual employees get 1 hour for each 30 hours worked. The yearly entitlement is based on an employees ordinary hours of work and is 10 days for full-time employees and pro-rata for part-time employees. Paid sick leave for up to 3 sick days in 2022.

The draft scheme will introduce. This entitlement is in addition to the 3 days of unpaid sick leave currently provided by the Employment Standards Act. Statutory Sick Pay SSP is 9635 a week and can be paid by an employer for up to 28 weeks. This can be calculated as 126 of an employees ordinary hours of work in a year.

In 2021-22 the weekly rate is 9635 and applies from 6 April 2021 to 5 April 2022. Number of hours paid sick leave owed Total hours of sick leave accrued -Sick leave already taken Sick leave hours owed If you have any queries about sick leave please contact Wageline on 1300 655 266 or wagelinecommercewagovau. The Government has announced a new Statutory Sick Pay Scheme. Leave accumulates gradually during the year and.

Statutory Sick Pay Ssp Incl Coronavirus Update Moneysoft

Sick Leave Conversion Chart U S Geological Survey

Leave Calculations Myob Essentials Accounting Myob Help Centre

Statutory Sick Pay Normal Sick Leave Brightpay Documentation

Leave Calculations Myob Essentials Accounting Myob Help Centre

Posting Komentar untuk "sick pay calculator"